COVID-19 Demands a New Approach to Education Finance

July 2, 2020

By Nora Delaney

For many Americans student debt is a growing crisis, rooted in decades of skyrocketing tuition costs and uncertain outcomes in a competitive and rapidly evolving labor market.

Most recently, the economic consequences of the COVID-19 pandemic have exposed deep vulnerabilities and accelerated profound shifts in the American workforce.

As the crisis continues to unfold, it seems likely that the student debt crisis will deepen further, raising critical questions over the costs and value of higher education, as well as the incentive structure of the financing that supports it.The current crisis highlights the need for a flexible financing tool that aligns schools’ and investors’ interests with student outcomes, protecting students against both structural changes in our economy and earnings shocks such as those brought about by the COVID-19 pandemic.

Income-share agreements (ISAs) link repayment to financial means, addressing key shortcomings of the existing student loan system that have only been compounded by the economic fallout of the pandemic. The expanding nature and scope of financial suffering attributable to inflexible and unsuitable student loan structures is a call to action for an affordable and accountable alternative financing option. ISAs draw a direct link between students’ education and career outcomes, creating incentives for education providers to prepare graduates with the skills to compete and succeed in the labor market. This accountability is missing at present, as students’ tuition payments are made regardless of their career outcomes or debt burden after graduation. And, there is reason to believe that American student borrowers are a captive audience. As our labor market evolves, college degrees continue to play a greater role in determining outcomes for American livelihoods.Those without a college degree earn less, experience greater unemployment, live shorter lives, and gather less social capital on average than peers with bachelor’s degrees.

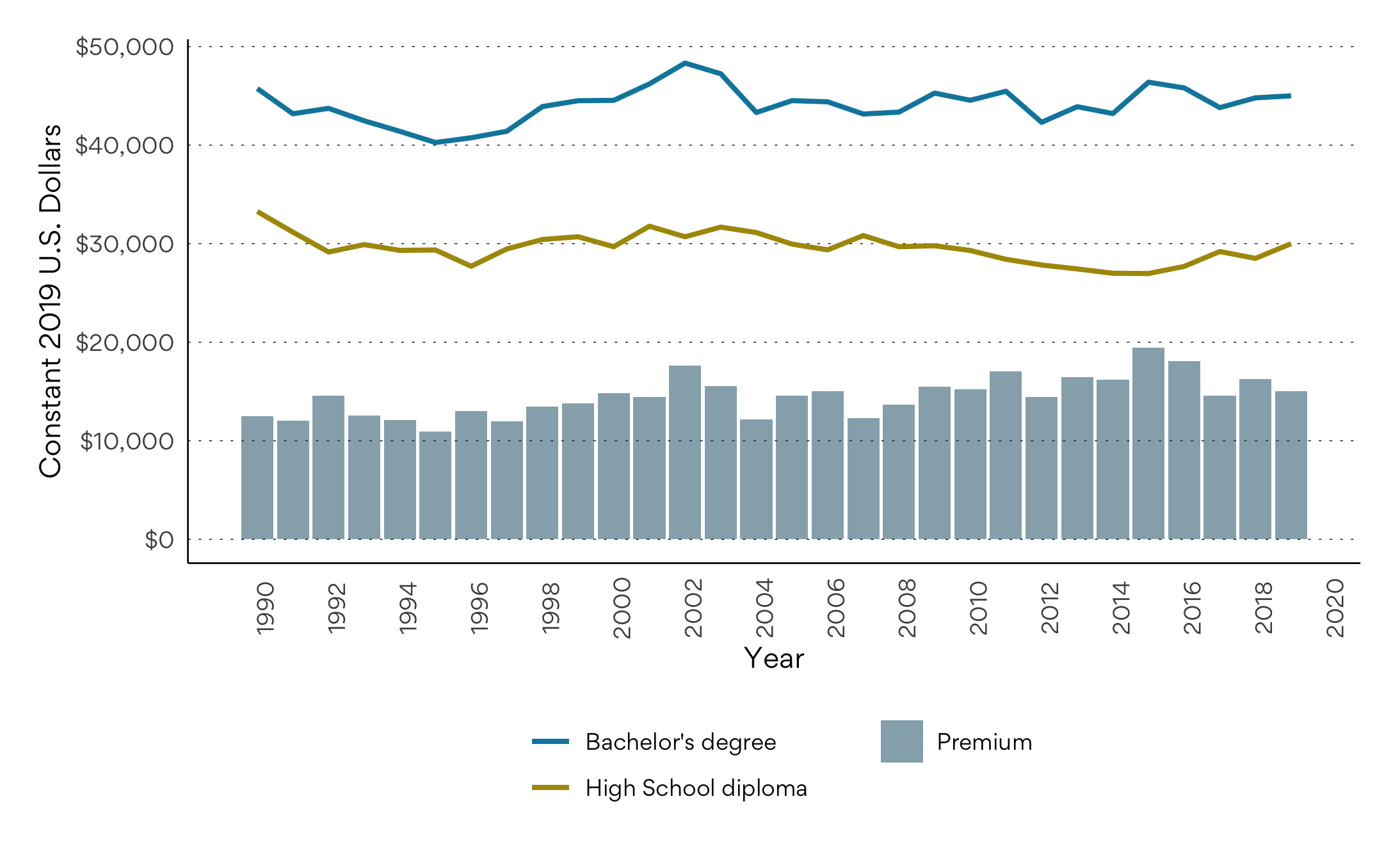

However, even as the cost of attendance rises, the financial benefits of higher education are far from assured and vary significantly among graduates. In 2019, the Federal Reserve Bank of New York found that graduates with a 4-year degree enjoyed an average 14% return on the cost of education over the course of their career. Yet, for the bottom quarter of earners with the same degree, returns to higher education were zero or negative. Downside risks to 4-year degrees may understate the risk of higher education investment more broadly, since roughly two in five college students are enrolled in a 2-year program or community college, according to government data.Earnings Differential: Median salaries by academic achievement

Source: Federal Reserve Bank of New York

The wild variation in returns to higher education calls for schools and student finance providers to reevaluate their role in a system that places a disproportionate burden of risk on students. As tuition costs rise, schools and student finance providers must demonstrate a commitment to preparing students for tangible employment opportunities.ISAs can facilitate a restructuring of student finance, limiting risk to borrowers who earn too little to qualify for payment and rewarding schools whose graduates enjoy prosperous careers.

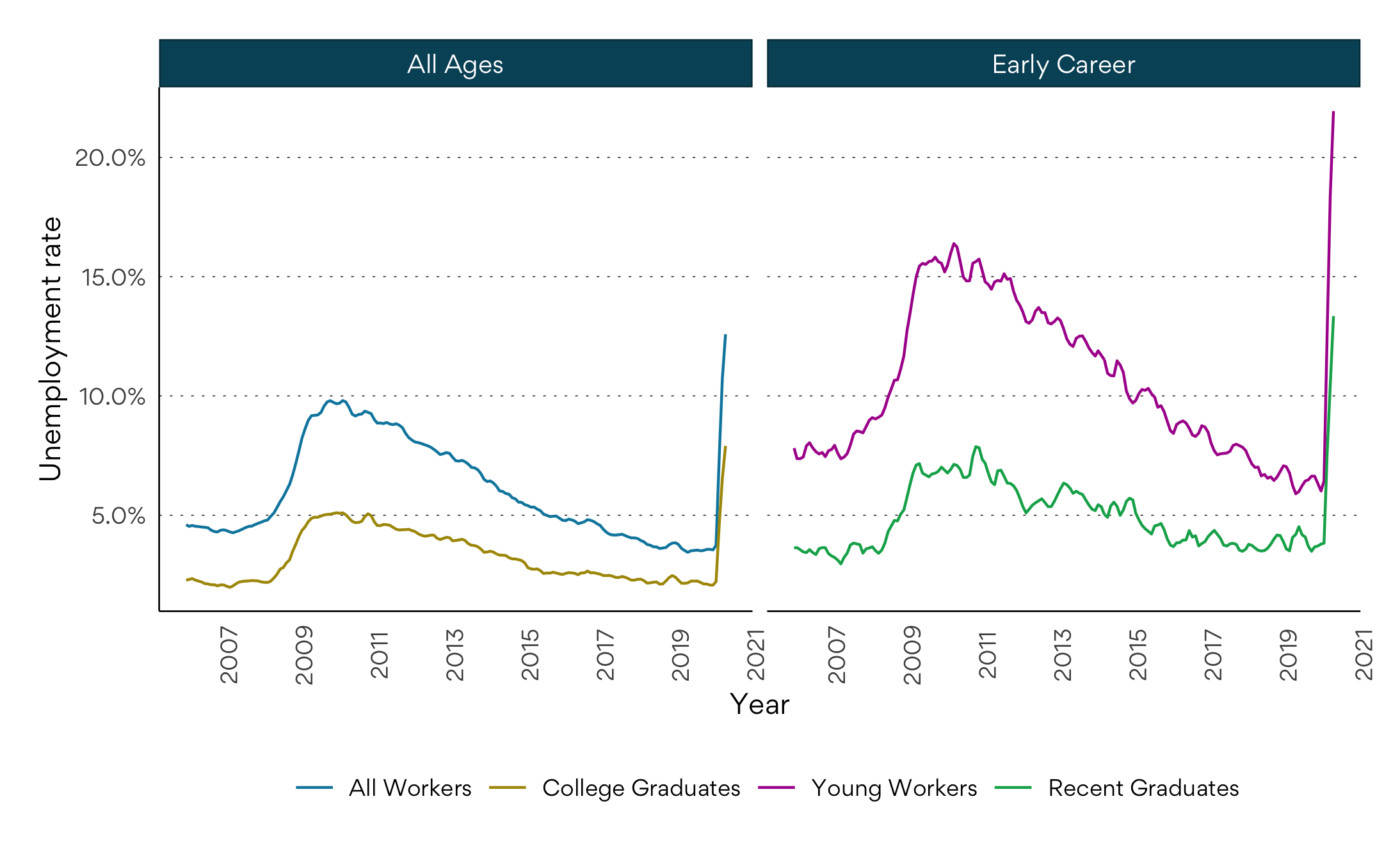

And, for new cohorts of enrolling students seeking financing sources, there is reason to believe that risk will play an outsized role in decision-making as prospective students take stock of the economic consequences of the virus. In recent months, even Americans with secure careers have found themselves in unforeseen and desperate circumstances as employers make unprecedented cuts to payrolls that have raised unemployment rates to a staggering 16%. The rapid shift towards remote work and the acceleration of trends favoring automation over human labor, and e-commerce in place of brick-and-mortar transactions foreshadow profound and potentially permanent transformations in the nature of work in America. Meanwhile, forecasts about the speed and scope of economic recovery vary widely. With federal student loan cohort default rates already hovering around 10% since 2015, defaults are set to jump this fall as student loan payments are resumed and borrowers struggle to make payments.Joblessness Foreshadows Debt Distress