Looking Beyond Income Share

August 5, 2020

By Nora Delaney

At Outcome, we believe that ISAs have the potential to revolutionize student borrowing experiences.

Income-share agreements (ISAs) are an innovative higher education financing tool that links repayments to graduates’ level of income.

Unlike student loans, ISAs do not carry an outstanding balance and do not accumulate interest, meaning that overall repayment is always linked to borrowers’ financial means. ISAs empower students to pursue academic and professional ambitions without fear of crippling student loan repayments after graduation. However, as ISAs gain popularity, much attention has focused on program design and its implications for borrowers. After all, if borrowers pay a fixed percentage of their income, should students enrolled in ISAs be concerned about making excessively large payments in dollar terms as they gather steam in successful careers? The answer is both yes and no, depending entirely on the quality and foresight of the ISA program design undertaken by higher education providers and their partners.Outcome prioritizes flexible and fair higher education financing, with student-oriented protections built in to serve borrowers at every point along the income spectrum.

In practice this means that, while income share is an important indicator of an ISA’s affordability, it may not tell the full story. Additional ISA program characteristics such as payment caps that limit the amount students can pay in a given year–or over the course of the entire ISA–set an upper bound on how much high earners can pay. What’s more, the length of an ISA’s contract term sets the context for all other program characteristics. While short program terms may be appropriate for some educational program types, they also require a higher level of income share than longer ISA programs. While some students may be willing to pay a high income share for two or more years, few will find the payments sustainable over a ten year timeline or longer. Similarly, lower aggregate payment limits should correspond to shorter contract terms, so that a high cap over a short repayment period does not result in a high realized APR for high earners.As a highly flexible financing tool, ISAs not only scale payments to borrowers’ financial means, but also offer numerous exit points as students meet one of several criteria for an ISA contract to expire.

The amount of time students spend under the financial obligation of an ISA contract is highly variable, even within the same ISA program.

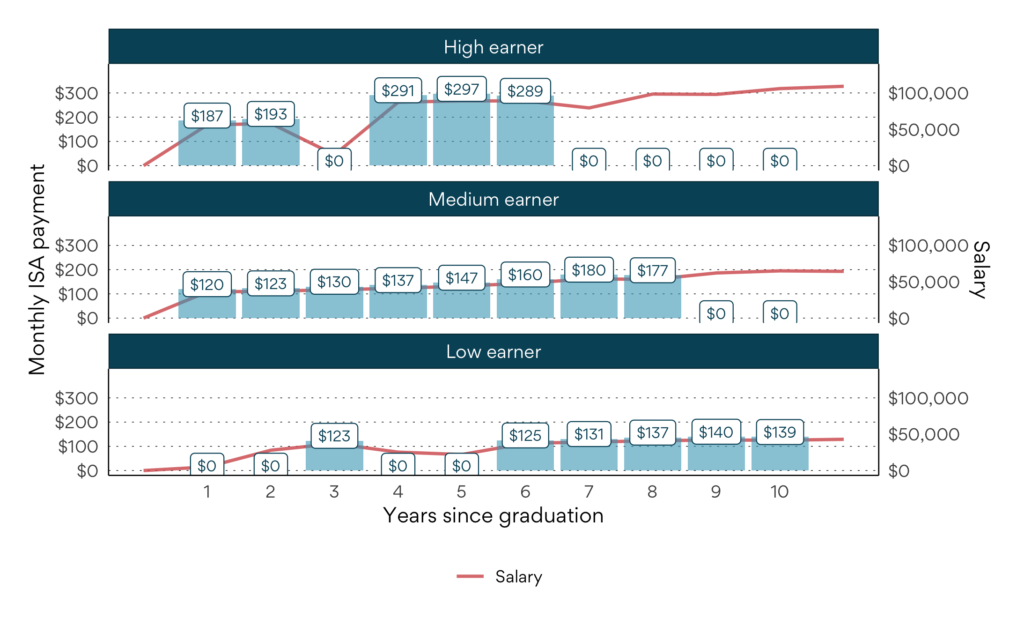

For example, consider the experiences of three borrowers enrolled in the same ISA program. Each student borrows $10,000 to finance their education and agrees to pay 4% of their qualifying income above a $35,000 annual income threshold. Each student can make either a maximum of 8 years of payments or $15,000 in total payments during the 10-year contract. After graduation, the borrowers continue into career trajectories with high, medium, and low earnings rates, and we begin to see how their repayment experiences diverge according to the flexibility of the ISA contract terms.Scaling Monthly Payments to Annual Income

The number and amounts of monthly payment vary between borrowers as each completes their own ISA obligation.

Each borrower exits the ISA obligation for a different reason. The highest earner completes the ISA after 5 years, once total payments meet the $15,000 payment limit. A medium earner completes the ISA after 8 years of steady employment and continuous monthly payments. A low earner, whose unsteady income has qualified for only 6 years of monthly payments, exits the ISA when the contract term expires, regardless of the total amount he has repaid.Comparing Repayment Experiences

| Highest Monthly Payment | Total Payment under ISA | Number of Monthly Payments | Years below $35,000 Income Threshold | Years under the ISA contract | Reason for ISA contract expiration | |

|---|---|---|---|---|---|---|

| High earner | $289 | $15,000 | 60 | 1 | 6 | Met total payment limit |

| Medium earner | $177 | $14,088 | 96 | 0 | 8 | Met maximum number of |

| Low earner | $140 | $9,540 | 72 | 4 | 10 | Contract term expired |