ISA Investing in the Age of COVID-19

September 21, 2020

By Jim Courtland

Income Share Agreements represent an innovation in education financing and have the potential to increase social mobility by de-risking the decision to pursue higher learning while promoting proven educational programs.

For ISAs to exist, however, capital providers must be willing to become ISA stakeholders, bearing the aggregated risk of unpredictable post-education career outcomes.

Investment capital can come in many forms, be it donor or endowment capital, social impact funds, traditional lenders, or the public sector. Regardless of the capital source, an ISA program must deliver on its long-term financial goals in order to sustainably benefit students.

Given the economic fallout presently caused by the COVID-19 pandemic, current and potential ISA stakeholders might reasonably ask, “How did existing ISA programs account for this kind of economic disruption, and how will future ISA programs account for it?” To answer these questions, we must delve into the world of statistical modeling and economic forecasting.

The primary way an ISA model might account for an economic disruption is through its earnings forecast. This would require the model to assume economic conditions that include a large increase in unemployment as well as a drop in current earnings and near-term earnings growth. To do this, however, requires very good economic forecasting. A model has to accurately predict when economic conditions will change and by what magnitude. That predictive power needs to work in both directions as well, predicting both the downturn and the recovery.

Unfortunately, accurate economic forecasting is such a rare feat it could be argued that it simply does not exist.

Ex-post data consistently shows that the ability of both private sector and public sector economists to predict economic turning points is limited, and forecasts predicting the extent of decline during recessions miss by a wide margin more often than not. If forecasters within the most prestigious and well-financed public and private institutions have such a dubious track record, it certainly follows that economic forecasting for the purposes of ISA modeling will face similar challenges.

Yet, if econometric tools cannot reliably predict economic extremes how does forecasting account for an unprecedented, extreme crisis like the one we are living through today? The short answer is, it doesn’t. This isn’t likely to change going forward either. After all, who in their right mind would have included a deep global recession brought on almost overnight by a global pandemic in their economic forecast last year?

This is not cause for despair!

Just because we cannot predict negative events does not mean we cannot mitigate the risks associated with these events.

ISA programs as a whole can be designed to robustly mitigate the impact of unforeseen macroeconomic shocks from the financer’s perspective.

This can be accomplished by taking lessons from the insurance industry, as well as modern portfolio theory.

At its core an ISA carries many of the same elements as an insurance contract. For example, ISAs involve the pooling of losses as well as the transfer of risk. Given the similarities to insurance contracts it is reasonable to utilize some of the principles of actuarial risk management, used in the insurance industry, when determining how to manage the financial risk of an ISA program. While actuarial risk management involves the use of models to determine the most likely outcomes, it recognizes the limitations of these models.

As a result, there is a focus on developing methods for understanding the range of possible outcomes and for minimizing the risks that stem from using imperfect models.

The same approach can be taken with ISAs.

One method used by the insurance industry that the ISA industry can benefit from is scenario analysis. Scenario analysis is an assessment of a range of scenarios, including extreme ones, to help test the resilience of the current strategy. For ISAs, this would entail the testing of a proposed ISA program design across a range of extreme scenarios to determine the resilience of the program to the economic risks that the model cannot account for. In conducting this scenario analysis, or stress testing, an important concept comes to light: not all ISA programs are created equal.

Scenario analysis highlights financial risk

Disparate ISA program designs have varying sensitivity to macroeconomic shocks

A simple model can take a given economic / earnings forecast and calculate the expected return of an ISA program with a defined set of parameters. It may even solve for the Income Share that must be charged to achieve a target return.

Unlike a loan, however, designing an ISA involves a great deal more than setting a single price factor such as an income share or interest rate.

The risk/return profile of an ISA program is driven by a number of parameters, including the income threshold, payment limits, contract term and payment period.

All of these elements interact in complex ways, changing not only the expected return of the overall ISA program under a given economic scenario, but the resilience of an ISA program to changes in that economic scenario.

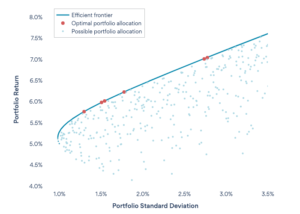

The Efficient Frontier

For a given return target, there are numerous ISA program designs that will have the same expected return while having vastly different program parameters. In this way, optimizing ISA program design is much like portfolio optimization within Asset Management. According to modern portfolio theory there are countless portfolios that can be created by varying the mix of assets in the portfolio, with each portfolio having a unique risk and return profile. Amongst all possible combinations of assets, there is an optimal set of portfolios that have the lowest risk for a given level of return. This is known as the Efficient Frontier. Similarly, across all combinations of parameters that define an ISA program, there are ISA program designs that carry the same expected return but are not equal in terms of the risks surrounding that return.

Like portfolios, ISA programs can be built to be more or less resistant to unexpected shocks to the economic forecast used to price them. This resilience can often be achieved without lowering the expected return.

Superior ISA program design involves the application of the above principles to create ISA programs that will meet their desired, aggregate return objectives while minimizing the risks that come with that return. This includes the risk of unexpected economic shocks, risk stemming from adverse selection, as well as distributional risks in which individual student experiences are problematic at the extremes. Econometric models that calculate expected returns for a given ISA program are a necessary element, but they are not sufficient. Through a more robust system that includes these actuarial risk management principles, we can create ISA programs that will be sustainable through whatever unpredictable economic cycles the future may hold.