5 Ways ISAs can Benefit Students

December 16, 2020

By Ali Fredman

Millennials are increasingly pessimistic about student debt amid the COVID-19 pandemic, generally believing that taking out student loans wasn’t worth attending college. According to a Morning Consult survey, nearly half of millennials (45 percent), now say that their college education isn’t worth their debt1https://morningconsult.com/2020/09/28/millennials-economy-student-debt-pandemic/.

Millennials today are less likely to earn more than their parents for the first time in American history. Compared with earlier generations, more young adults have outstanding student debt, and the amount of it they owe tends to be greater2https://www.pewsocialtrends.org/essay/millennial-life-how-young-adulthood-today-compares-with-prior-generations/. They’ve encountered the great recession of 2008 and now face the economic consequences of COVID-19.

What if there was a financial solution that promoted equity, alignment, and progressive outcomes? It’s not a myth; under the right program design and execution, this solution is called an Income Share Agreement (ISA). ISAs align a student’s repayment with the realization of positive student outcomes.

Read on to learn more about how ISAs benefit students:

1. Pursue higher education without the burden of loans

One reason many students are skeptical about pursuing higher education is that, without the certainty of a high paying job, the burden of private loans is simply too high. Missing payment on loans leads to deferment and possible default. Deferment can balloon a loan balance creating a perpetual state of indebtedness. Default affects one’s credit score and has long-term implications including access to rental housing, credit cards, mortgages, and auto loans, and restricts a borrower’s safety net to facilitate family planning, career changes, and geographic mobility. ISAs scale repayments to income, ensuring that payments are always affordable. Under ISAs, borrowers earning below a certain level of annual income don’t need to make payments and are protected from need-based defaults, thus improving their future access to credit. A loan might seem more certain, but is actually less flexible than an ISA, once you account for deferment and unexpected life events. With an ISA, a borrower knows the maximum length of time their obligation can last, and that they will never need to make payments when their earnings are low.

2. Remove psychological and emotional trauma associated with debt

When a student has financial distress, the last thing they need to worry about is the economic penalties associated with default (mentioned above). Not only do defaulting borrowers face decreased financial streams and social services—potentially compounding financial distress—but also reduced financial and professional opportunities in the future. This hardship can be personal but can also extend to a student’s family, creating enhanced psychological trauma. ISAs can help remove this trauma by reducing the payment burden to borrowers with lower earnings, helping those borrowers focus their financial resources where they are most needed during times of financial hardship. Additionally, as part of its design, ISAs have limits on payment amounts, number of monthly payments, and contract lengths, which help mitigate the accumulation of further debt. Students will not have to worry about harsh penalties while they are already struggling.

3. Empower students to invest in their education and career development

Every student has a unique path from graduation to their career with different stepping-stones, challenges, and timelines to success. ISAs allow recent graduates to take risks and focus on their long-term career prospects. So, an unpaid internship or a low paying job that will massively boost their resume or springboard their career becomes possible with an ISA. ISAs seek to empower students to invest in education with the freedom to know that repayments will always be affordable, giving students the confidence to invest in education and career development without fear of punitive debt burden.

4. Prioritize future earnings potential not past credit history or family wealth

Higher education should be about a student’s future, not their past. Students shouldn’t be burdened by their past or their upbringing. Instead, ISAs are focused on a student’s future earnings potential, not on their credit history, nor the financial history of their family. ISAs don’t require a cosigner and their eligibility is not predicated on a lengthy or perfect credit history, thus allowing students to forge their own path.

5. Align education costs with quality of labor market preparation received in school

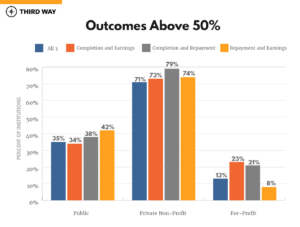

Too many institutions and programs of higher education entice students to enroll with promises of a quality education and excellent post-graduation opportunities. A study by the non-profit organization, Third Way, examined the proportion of institutions of higher education whose students’: completed their degree; earned more than the average high school graduate; and paid down their loan principal. The table below shows that only 13% of for-profit institutions show a majority of students realizing all three outcomes, and only 8% have more than half their students able to earn more than a high school graduate and begin paying down their loan principal3https://www.thirdway.org/report/the-state-of-american-higher-education-outcomes-in-2019.

The proportion of institutions that show most of their students completing, earning above the average high school graduate, and paying down their principal. Source: Third Way

In our current model of higher education financing, students bear the financial risk of pursuing a degree. Education providers enroll students with the promise of a quality education and future economic benefits of their degree, but the schools don’t share this risk with their students nor hold any financial accountability in helping students with paying back their debt.

ISAs can help our higher education financing system begin to align the incentives of higher education providers with their students in terms of quality of education, cost of attendance, and post-graduation employment outcomes.

With a more student-centric financing model, schools would share the risk of paying for higher education, signaling to students that their school believes in the economic value of their product and the economic future of their students. Students should feel unburdened to pursue a life and career of their choosing.

Income share agreements offer an equitable and reasonable solution to assuming student debt. Much like an insurance product, with ISAs students can take risks with their education and career without the fear and consequences of debt.

While millennials have been dealt an unfavorable economic hand, their future shouldn’t be encumbered from swinging for the fences. After all, isn’t that the American dream?