Morgan’s Story: What about student loans?

January 5, 2021

By Nora Delaney

Understanding and evaluating student financing options can be complex, which is why Outcome recently released our ISA narrative tool to show how ISAs work for a diverse set of students and professional paths.

Students who are interested in ISAs will want to know how they compare to conventional student loans.

It’s important to know that an ISA is not the same thing as a loan, although it is also a binding financial obligation. And, while ISAs offer many benefits that loans do not, there are also tradeoffs to each borrowing option.

In this blog post, we pick up with Morgan, a character from our ISA narrative. If you haven’t already explored the narrative tool, we recommend you do so before reading further.

We compare Morgan’s experience under an ISA to what might have happened if he had taken out a student loan instead.

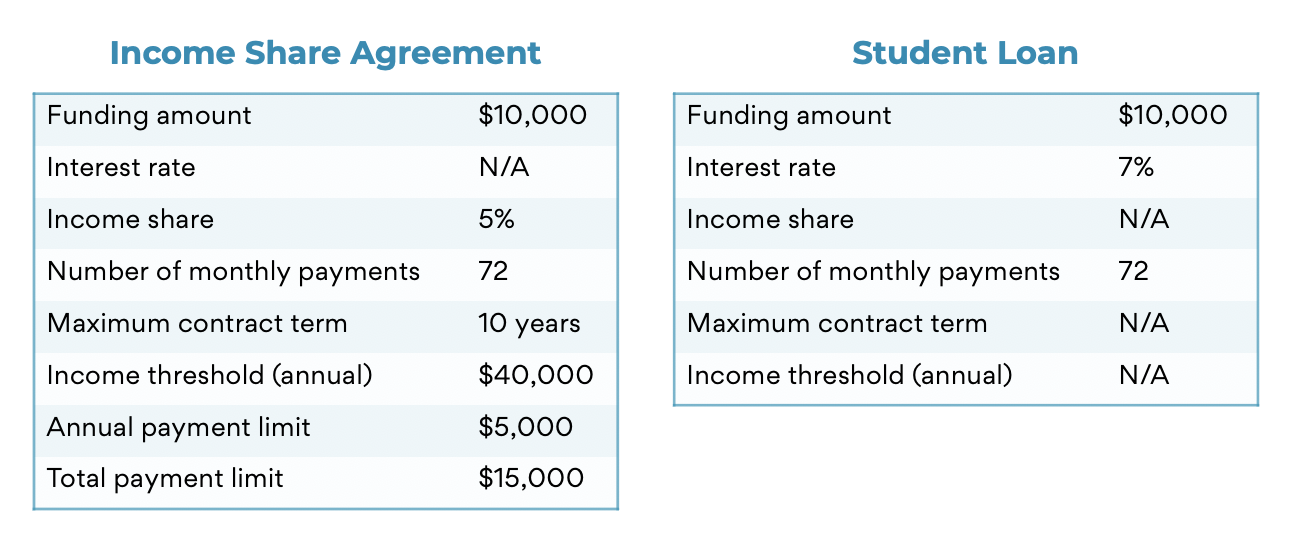

Borrowing Terms — Comparing an ISA with hypothetical student loan terms.

First, let’s look at a key difference between ISA and loan payments. ISA payments can vary in amount from month to month, since they are always calculated as a percent of a borrower’s current income. If a borrower loses their job or their annualized income falls below the income threshold, payments are automatically paused. Loans are different.

Loans set a fixed amount to be paid in monthly installments, regardless of the borrower’s current income.

Understanding the consequences of variable ISA payments and fixed loan payments is key to evaluating their impact on a borrower’s budget.

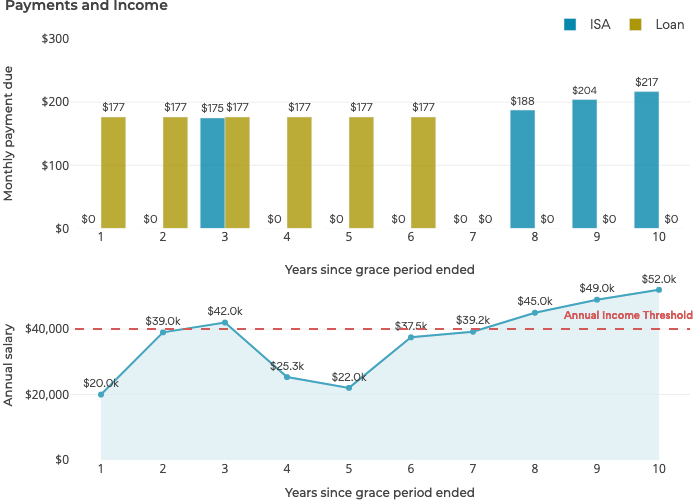

In Morgan’s case, we can see how loan and ISA payments compare. We have chosen hypothetical loan terms to illustrate an alternative borrowing experience for Morgan. Let’s assume that, no matter the financial difficulty Morgan goes through, he always manages to make his loan payments on time1Borrowers who are unable to make loan payments on time due to financial hardship may qualify for temporary relief under forbearance. While forbearance may pause a borrower’s payments, it does not pause accumulating interest on the outstanding loan balance owed. Click here to learn more about forbearance. and in full2Many borrowers may have the option to make a minimum payment which is less than the full amount due. Making minimum payments can increase the overall amount paid over the course of the loan due to the accumulation of interest. To learn more about the effects of minimum payments, click here.. Morgan’s loan payments are concentrated in the first six years of his story, at exactly the same time when he is having trouble building his career and he is earning the least. By contrast, Morgan’s ISA payments are paused when his income is too low to qualify, allowing him to redirect the income he is earning towards other areas of need in his budget.

Students who are familiar with loans may be uncomfortable with Morgan’s paused payments. After all, loan forbearance can lead to a ballooning loan balance as payments are paused and interest accrues. However, pausing payments under an ISA doesn’t have the same consequences as pausing under a loan.

Unlike loans, ISAs don’t have an interest rate or an outstanding balance.

While loans are concluded once the balance is paid down to zero, ISAs use different criteria to determine when the ISA is over. Once a borrower meets any of the three ISA exit criteria, the contract ends. An ISA can end when the contract’s maximum number of payments are made, when the maximum aggregate payment cap is met, or the when contract expires due to the amount of time that has passed. The number of months or years a borrower falls below the Income Threshold cannot change the ISA exit triggers.

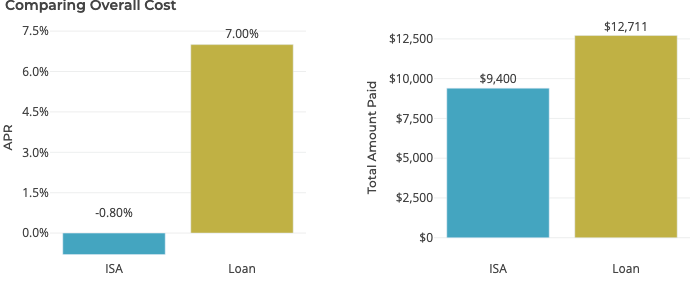

Understanding how the idea of a loan balance or the total amount owed differs between a loan and ISA is also important in order to meaningfully compare the total amount Morgan pays in each scenario. Under the ISA scenario, Morgan pays substantially less than he would under the loan scenario, both in dollar terms and in terms of the effective APR implied by his payments under each scenario.

So, is an ISA the better option?

Unfortunately, it’s not so easy to say.

While Morgan’s character could look back retrospectively and clearly see that he would pay less with an ISA than a loan, this isn’t necessarily guaranteed. After all, Morgan’s character might have paid more with an ISA if he hadn’t graduated during a recession or had landed a high paying job earlier.

Comparing total payment amounts is not the only–or the best–metric for comparing loan and ISA borrowing options. ISAs are designed specifically to adapt to the unique professional and financial circumstances of the borrower, while loans are not. Loans, with their predictable fixed payments, may seem like the simpler option at first glance but they can quickly become complex and unaffordable under unanticipated circumstances. Deciding which funding mechanism is best will depend on each individual borrowers’ risk tolerance and certainty about the future of their career and finances.