Introducing Outcome’s ISA Narrative Tool

April 26, 2021

By Jim Courtland

We are experiencing a crisis in higher education tied directly to education financing.

Federal loans, grants, and scholarships have not kept pace with the meteoric rise in the cost of traditional higher education programs. For many Americans, the risk that the return on an educational investment will fail to cover the cost is simply too high. Unfortunately, this cycle and the chase for upward social mobility has left many families with no choice but to accrue massive debt.

We believe the risks associated with higher education financing should be borne by institutions rather than individual students.

That is why we created Outcome, with the goal of sustainably and responsibly expanding access to a new education financing structure that shifts the risk of poor student outcomes from the students to the lenders, thereby aligning the long-term interests of students, lenders, and education providers. This financing structure, known as an Income Share Agreement (ISA), links repayments to post-graduate income while including built-in protection for borrowers experiencing low or no income. As a result, ISAs have the potential to increase social mobility by derisking the pursuit of higher learning and promoting proven educational programs.

For all their promise, however, ISAs are complex and easily misunderstood by the average student or consumer.

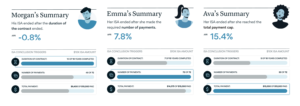

That’s why we launched a new ISA Narrative tool. Using a narrative approach for describing what payments might look like under an ISA, our tool highlights three very different student profiles and their financing outcomes under a hypothetical ISA program.

These profiles cover various career paths, from a student with elevated earnings to one with a more volatile career path. Through their paths, we highlight the ways in which ISA terms, such as the minimum income threshold and payment limits, interact with potential career events like an economic downturn or a transition to a high-paying, commissions-based role. This creates a way for students to project uncertainties and aspirations for the future onto relatable narratives.

Our goal with this tool is to help contextualize the various parameters of an ISA in a way that’s easy to understand.

This is critical because thus far, the ISA industry has struggled to find ways to effectively communicate the many implications of ISAs to student borrowers.

ISAs can mitigate the risks associated with higher education, however, students must understand the tradeoffs of this financing alternative in order to make informed decisions.

For industry practitioners who earnestly wish to create educational resources that will help students make informed decisions, ISA’s relative complexity is a persistent hurdle. Ultimately, our goal is to ensure that students and their advisors have the information they need to feel confident making financial decisions for their own circumstances. While no solution is perfect, we hope that this tool will serve as a next step in the effort to foster understanding of both the benefits and risks that come with this new form of borrowing.

If you would like to explore the ISA Narrative tool yourself, please click here!