Should ISAs replace student loans?

September 18, 2020

By Nora Delaney

Income-share agreements (ISAs) are building a reputation as a flexible alternative to traditional student loans. But, does that mean they will replace student loans entirely?

At Outcome, we believe that ISAs are a solution to some of the most deeply-rooted problems with student loans. However, understanding the nuances of ISAs is key for any borrower to choose not only whether to borrow from an ISA program, but also how much. There’s no hard and fast rule that borrowing students can only take out an ISA or student loan.

In fact, ISAs can be a powerful complement to student loan financing, as each student chooses a financing strategy that is best for them.

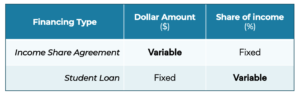

Under an ISA, borrowers agree to pay a fixed percentage of their earnings each month. This allows monthly payments to vary as borrowers’ income goes up and down, ensuring that payments are always affordable. By contrast, traditional student loans require a fixed, consistent dollar amount in payments each month.

So, which is better for borrowers? Ultimately, the answer depends on each borrower’s needs. Borrowers who know that they will have consistent earnings that will always cover the fixed payments of a traditional student loan may prefer a loan option. However, traditional student loan payments can be unforgiving for individuals experiencing financial hardship or job loss, not to mention student borrowers whose post-graduation career outcomes fall short of expectations.

A majority of borrowers may find that ISAs offer more flexibility and better insurance against financial hardship–and the adversity of need-based defaults.

ISAs contain a built-in mechanism to suspend the payments during periods of financial hardship. Unlike loans, ISAs don’t have an outstanding balance or an interest rate, meaning that periods of non-payment do not increase the scale of the overall financial obligation.

Ultimately, the key to deciding between an ISA and a student loan lies in predictability.

Monthly payment characteristics — ISAs represent a predictable share of monthly earnings even though dollar payments vary

While student loans offer predictable monthly payments in dollar terms, the share of income those payments represents changes with borrowers income. ISAs ensure that payments will predictably represent an affordable share of total income.

For example, a $350 monthly loan payment may be affordable to a borrower with a $60,000 annual salary, representing 7% of her overall earnings. However, if her income drops to $30,000, the same $350 monthly payment represents a much larger share–14%–of her income. For borrowers balancing a budget from month to month, student loan payments can eat up an unpredictable share of monthly earnings.

By contrast, under an ISA with a 7% income share, the borrower would pay $350 monthly while earning $60,000 annually. If she experiences a loss of income, the value of her monthly payments declines or drops to zero if her income drops below the ISA’s income threshold.

Comparing Payment Dynamics

The plots assume a $350 fixed monthly student loan payment and a $35k income threshold

So far, we’ve assumed that borrowers can either borrow through a traditional student loan or through an ISA. In reality, many students will choose to combine ISA funding with student loans. This approach has many benefits, particularly for students who find aspects of both loans and ISAs appealing.

In particular, ISAs may be an attractive option for students who have already maxed out federal student loan limits but who are still facing a financing gap.

For students who are borrowing larger amounts to finance degree completion, the safety net that ISAs offer can be a key component in moderating downside financial risk.

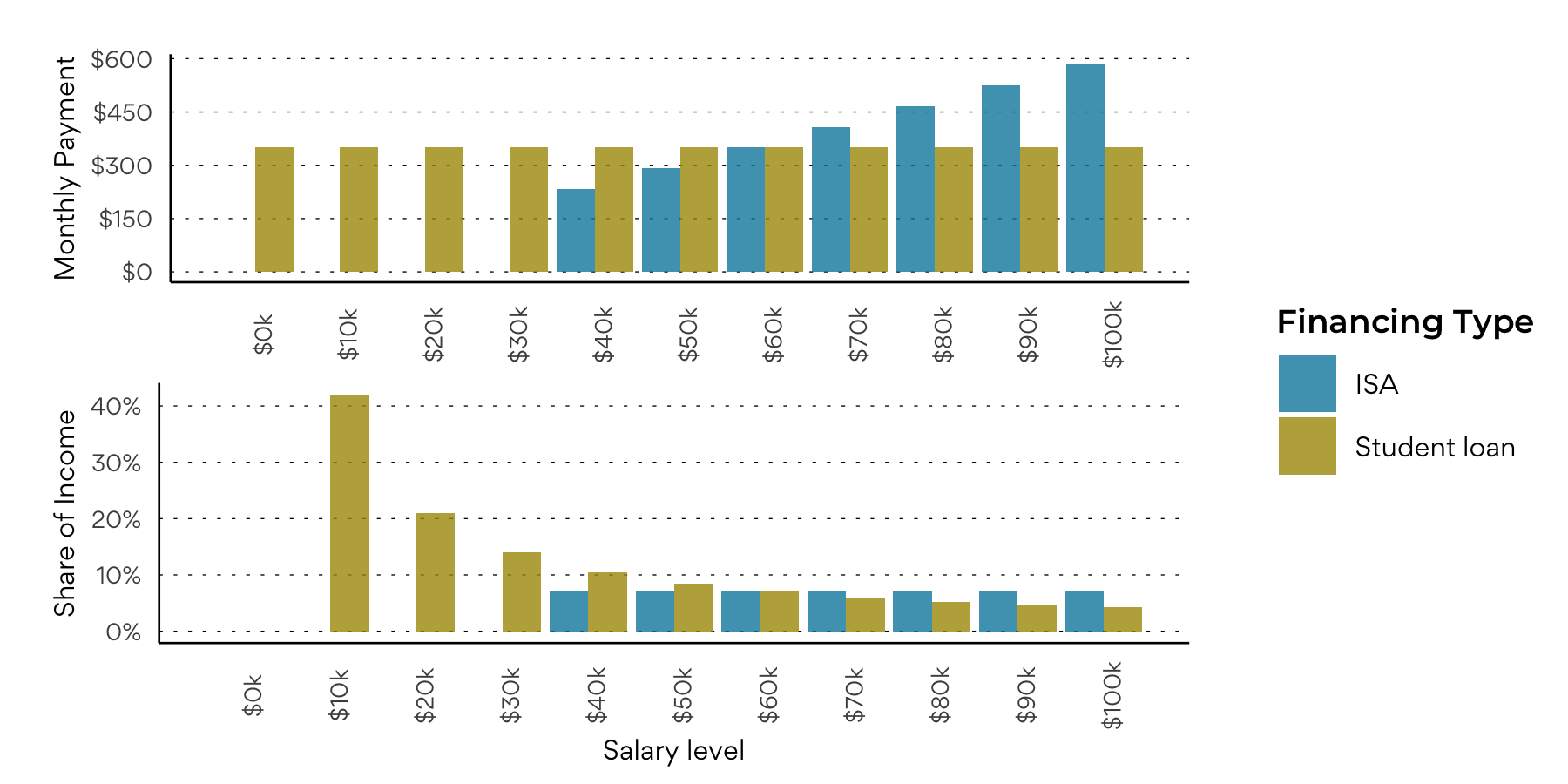

For example, consider a student who will need $30,000 in financing to complete a degree. The same student can choose between a 10-year ISA program with a 7% income share or a 10-year student loan with fixed $350 monthly payments. The ISA program has an income threshold of $35,000, meaning that she does not make payment when her annualized income is below this level. The student can choose how much to borrow from either the student loan program or the ISA to cover her $30,000 financing gap.

Choosing a hypothetical salary path for the student after graduation, we can begin to examine the tradeoffs of an ISA versus a student loan. If the student chooses to cover costs entirely through student loans, her fixed payments account for up to 15% of her total income throughout the repayment period. In contrast, as the student chooses to borrow less in loans and more through an ISA, the monthly share of her income that her payments represent gradually approaches the ISA income share of 7%. As the middle panel of the graph below shows, mixing ISA and loan financing can bring the best of both worlds–dampening the variability in the percent of monthly income payments can eat up while also bringing some level of predictability in payments’ dollar amounts.

Mixing ISA and Loans

A hypothetical borrower repayment experience

ISAs are designed as a flexible student finance tool that adapts to a students’ circumstances and professional development. However, it can also be a powerful complement to student loans, introducing an element of repayment insurance to borrowers who may be balancing a variety of student financing resources including loan, grant, and ISA funding. While ISAs are a great borrowing option when used in isolation, ISAs can also dampen the overall financial burden as a portion of overall earnings for students with more complex borrowing portfolios.

While the ISA industry is growing fast, it is still young. Most colleges still don’t offer an ISA financing option, and students and their financial advisors are still working to understand the financial tool and its implications. While it may be too soon to say whether ISAs will eventually replace the $1.4 trillion in outstanding federal student loans or the $125 billion in private student loans, ISAs meet a critical demand for a flexible student finance tool that links repayments to outcomes.