The APR-based protection no borrower should go without

June 21, 2021

By Nora Delaney

Choosing to borrow funds to cover the cost of higher education can be a momentous decision.

For many student borrowers, securing financing to cover tuition and living costs can represent a years- or even decades-long repayment commitment. While some borrowers will prefer to spread payments over many years, others may strive to get the payment obligation over with as quickly as possible. While loan prepayment is a straightforward question of paying down the outstanding balance, many Income Share Agreements available on the market have failed to offer favorable prepayment options to borrowers.

Setting and communicating a transparent overall borrowing cost is a crucial element of any student-centric ISA design.

For certain borrowers, ISA prepayment may be an attractive way to close out the obligation before moving into new life phases and financial circumstances. However, prepayment of ISAs presents unique challenges in terms of the overall cost of financing it implies for students. The ISA industry has typically relied on aggregate payment caps, which set a fixed nominal payment value that students can meet at any time to end the ISA obligation. While aggregate payment caps are an important student protection, they are an incomplete tool for managing affordable and fair ISA prepayment. To understand why, we need to consider time value of money.

prepayment of ISAs presents unique challenges in terms of the overall cost of financing it implies for students. The ISA industry has typically relied on aggregate payment caps, which set a fixed nominal payment value that students can meet at any time to end the ISA obligation. While aggregate payment caps are an important student protection, they are an incomplete tool for managing affordable and fair ISA prepayment. To understand why, we need to consider time value of money.

Affordable prepayment isn’t just a question of how much a borrower repays, but when they pay it.

APR is a common method for assessing the affordability of borrowing across time. Borrowers may be familiar with APR if they have applied for a loan or credit card. APR is similar (but not identical) to the interest rate on a loan.

Unlike nominal metrics of total repayment—like an aggregate payment cap—APR (Annual Percentage Rate) uses time value of money to measure the relative value of past, present, and future payments against the original amount borrowed. Measuring ISA payments in terms of time value of money can be counterintuitive. After all, unlike loans, ISAs don’t have an interest rate or an outstanding balance that must be paid down before the obligation is over. However, we can calculate the APR of an ISA once it has been paid off!

From a cost-of-borrowing perspective, the timing of payments matters. The value of a dollar received today will almost always be higher than the value of the same dollar received tomorrow. The reasoning goes that a dollar received yesterday could have been invested and have grown slightly in value. By that logic, we can safely say that the value of an ISA aggregate payment cap repaid today will also be higher than the value of that same cap amount reached in three, five, or even ten years. Paying the same flat, nominal aggregate cap value at an earlier point in time will have a higher, and perhaps wildly more expensive, time-adjusted cost for students.

To truly protect borrowers, the ISA industry must implement time-dependent APR payment caps.

To be sure, adding APR into an ISA further complicates an already multifaceted financial contract. However, communicating APR as a student protection is crucial for borrowers.

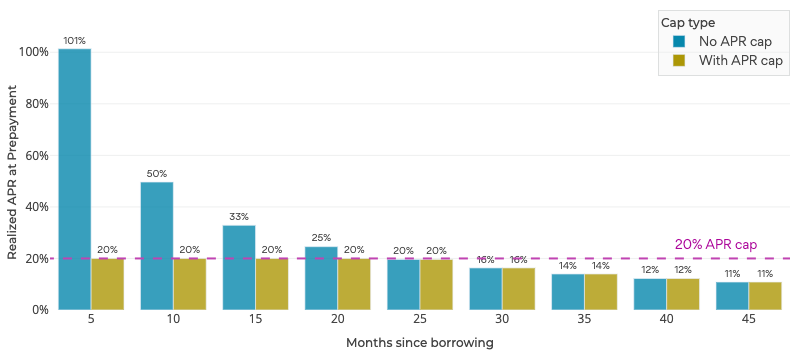

To illustrate the point, let’s consider a hypothetical student who borrowed $10,000 through an ISA with a 1.5x aggregate payment cap. To exit the ISA at any time, she may pay $15,000, either all at once or as the sum of several payments made to date. While prepayment based on an aggregate cap may seem straightforward and student-friendly at first glance, nominal payment caps can result in potentially extreme distortions when viewed from a time value of money perspective.

Let’s imagine that our student lands her first job 5 months after borrowing through an ISA, and decides she wants to use her signing bonus to terminate her ISA obligation. She hasn’t yet made any payments, so she will pay $15,000 in a single lump sum. But doing so will put the APR for her ISA at a staggering 101%!

By comparison, if the same borrower didn’t make any payments for 35 months following the borrowing date and then paid off her ISA in month 35, her realized APR would be just 14%.

Cost of prepayment

APR decreases over time if a students pays off an ISA with a 1.5x aggregate cap in a single lump sum

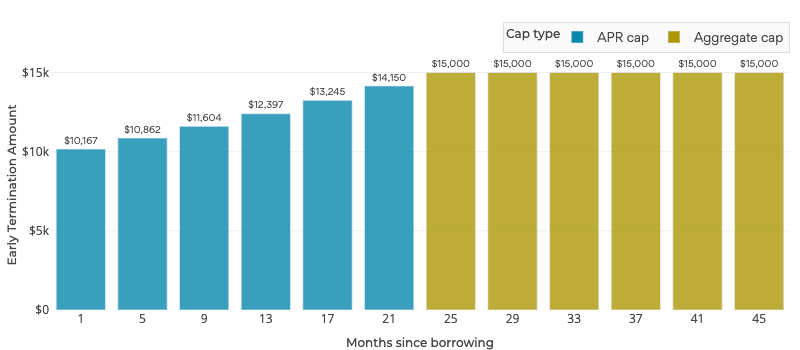

By contractually setting an APR cap at a manageable level—say 20%—Outcome’s ISA agreements ensure that borrowers can affordably and predictably prepay their ISA obligation at any stage of repayment. In other words, setting a constant value for APR ensures that the nominal value of prepayments starts low and grows over time just until it matches the aggregate cap value. The maximum amount a student must pay to exit an ISA obligation will always be the lesser value of either the APR-based early termination value or the aggregate cap value.

APR caps result in a graduated prepayment schedule

With APR caps, the nominal amount due to end an ISA obligation starts low and grows up to but never beyond the aggregate cap value

So, if ISAs are using APR, how are they different from conventional student loans?

Loans and ISAs differ in both the number and nature of the ways that a borrower can end the financial obligation. Typically, loans accrue interest on a balance that borrowers must pay down in order to exit the loan. If a borrower goes into forbearance or only makes small monthly payments, the balance of the loan can grow over time. By comparison, an ISA borrower’s obligation is over once a certain period of time has passed, they make a maximum number of payments, or they pay an amount sufficiently high to terminate the obligation. It’s important to understand that adding an APR cap to an ISA obligation doesn’t change the ways that a student can exit the obligation, it merely adds another level of protection to moderate the maximum amount a borrower can pay over the course of their contract.

Implementing an APR cap doesn’t mean that all students need to pay up to the cap value.

The APR cap serves as a protective feature for successful students, including both those who make large monthly payments and those who choose to opt out of their ISA obligation early. For other students, features like the ISA income threshold and the maximum contract term ensure that students in low- to moderate-earning circumstances have an affordable pathway out of the ISA, regardless of how low their realized APR ultimately is.

The bottom line: what the ISA industry can do now to protect borrowers

The ISA industry has prided itself on the flexibility and student-friendly provisions that ISAs automatically build in for borrowers. This pride is well-justified for programs that insulate borrowers in periods of financial hardship from undue repayment obligation. However, the ISA industry has fallen short in appropriately moderating the repayment experiences of successful borrowers, in some cases leading to punitively expensive consequences for higher earners.

APR is a cost-of-borrowing metric used across the consumer finance industry to help borrowers understand the time-adjusted affordability of lending products with different maturities. ISAs can be complicated, not to mention difficult to compare on the basis of overall cost once we factor in their many parameters and components. Setting a maximum APR for students serves the dual purpose of clearly stating an absolute maximum cost of borrowing and also providing a crucial mechanism for early termination for students who are willing and able to prepay their ISA obligations.