Biden Student Debt Plan is a Step in THE Right Direction

August 29, 2022

By Jim Courtland

This past week the Biden administration announced their long awaited plans regarding student debt relief.

The key components of the plan are that Americans earning less than $125,000 (or households earning less than $250,000) are eligible to have up to $10,000 of federal student loan debt and/or PLUS loans forgiven. Borrowers who received a Pell Grant, and meet the income requirements, can have up to $20,000 of debt forgiven. Additionally, the current pause on student loan payments has been extended until the end of the year.

This decision landed amidst a flurry of controversy, which may have been unavoidable regardless of what actions were or were not taken on this issue. Critics on one end of the spectrum feel this action falls far short of what should be done to address the existing crisis and the disparities it has created, while critics on the other end of the spectrum feel this is an unfair and/or unnecessary handout that could further stoke inflation.

As an example of targeted fiscal stimulus, reasonable people can and will disagree as to whether this is being enacted at the right time, in the right amount, or in the right manner. We will leave the questions around stimulus timing and amount aside, as these have little to do with higher education or the student debt crisis. In terms of the manner in which this stimulus is being enacted, it is our view that this debt relief is in fact well targeted.

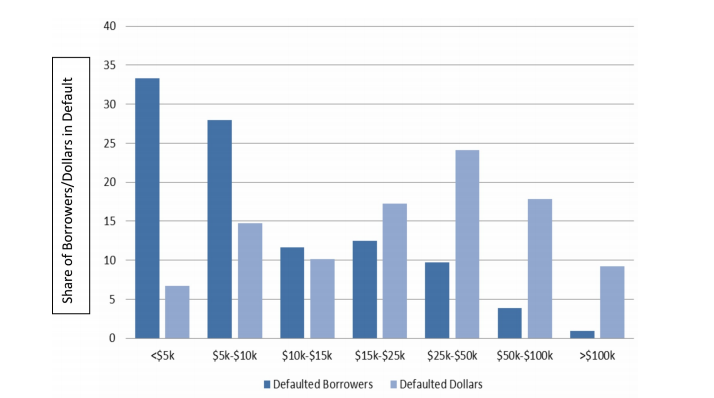

The Biden administration appears to understand that the most perilous portion of the student debt burden is held by borrowers with relatively small debt loads. High earners with advanced degrees hold a disproportionate share of outstanding student debt, yet borrowers with only an Associate’s degree or less represent an outsized proportion of all student debt holders.

Source: Adam Looney and Constantine Yannelis in the August 2019 issue of Economics of Education Review

And these borrowers with smaller debt burdens and less advanced degrees are the ones struggling the most with their student debt. In 2019, the Economics of Education Review revealed that nearly 60 percent of all the borrowers in default owe less than $10,000, with most owing less than $5000, compared to 4% for those who borrow more than $100,0001https://hechingerreport.org/the-new-low-income-big-borrower-of-student-loans/. A related study by Judith Scott-Clayton of Columbia found that borrowers without a degree have a 40% default rate, while the rate is only 8% for those with a bachelor’s degree. 2https://www.brookings.edu/wp-content/uploads/2018/01/scott-clayton-report.pdf

In short, the issue is low earnings, not high debt.

The debt forgiveness plan’s income requirement, and relatively modest degree of debt forgiveness, make it reasonably targeted at the borrowers who need it most. High earning borrowers receive no forgiveness, while low earning borrowers with incomplete degrees and modest debt burdens will receive much needed relief. Meanwhile, lower earning borrowers with advanced degrees and high debt burdens receive only partial forgiveness. Providing additional benefit to Pell Grant recipients helps to further target relief to the most vulnerable borrowers, and to advance racial equity given that black borrowers are twice as likely to have received Pell Grants compared to their white peers. 3https://www.whitehouse.gov/briefing-room/statements-releases/2022/08/24/fact-sheet-president-biden-announces-student-loan-relief-for-borrowers-who-need-it-most/

Despite being well targeted, the debt forgiveness merely attacks the symptoms of the student debt crisis while doing nothing to address the underlying disease. It may have merits as a form of fiscal stimulus, but it is not a solution to the student debt crisis. The Federal government’s ongoing efforts to provide more affordable debt to student borrowers is not helpful if the debt doesn’t create value for the borrower. Ultimately, any solution to this crisis will have to ensure that the financing provided for higher education is getting a reasonable return on investment.

Interestingly, the parts of Biden’s proposal that extend beyond a one-time stimulus payment appear to take their inspiration from outcome-based lending solutions. The proposed changes to the Federal income-driven repayment plans would effectively convert this program into a full-blown outcome-based loan. This program would now have a higher income threshold below which borrowers monthly payment falls to zero. It would also include a 10-year payment period that, when reached, would immediately end the obligation with no accrued interest regardless of the amount paid.

This will make the income-driven repayment program structurally indistinguishable from outcome-based solutions currently supported by companies like Outcome, including Income Share Agreements.

We welcome these proposals from the Biden administration, and applaud their decision to embrace outcome-driven lending solutions. The student protections baked into this form of lending have clear benefits, and the federal application of this lending structure will help pave the way for responsible, private sector solutions that make greater use of this model. It is our hope that the public sector continues to push towards solutions that increase transparency, foster innovation, and enforce accountability within the higher education system.